Conductive paste is hot, so what are cobalt-free batteries? Can it be broken?

The market space of nearly 2.8 billion has also attracted competition from the capital market and industry giants. The next competition for lithium battery conductive materials will also be a game between industry giants.

Carbon nanotube conductive slurries are accelerating to replace traditional conductive materials, and the industry structure is gradually becoming layered. A competition surrounding technology, capital, and production capacity has also begun.

Data from the GGII Lithium Battery Research Institute (GGII) shows that domestic carbon nanotube conductive slurry shipments in 2019 were approximately 35,800 tons (converted based on 4% solid content), a year-on-year increase of 10%. GGII predicts that the market size of carbon nanotube conductive paste will exceed 70,000 tons in 2020.

The market space of nearly 2.8 billion has also attracted competition from the capital market and industry giants. The next competition for lithium battery conductive materials will also be a game between industry giants.

GGII research data shows that in 2019, the shipments of TOP 5 carbon nanotube conductive paste companies accounted for 92.8%. Tiannai Technology, Sanshun Nano (acquired by Cabot), Qingdao Haoxin and other enterprises are among them.

Gaogong Lithium Battery has learned that in order to cooperate with the production capacity deployment of power battery giants, Tiannai Technology, Cabot, Qingdao Haoxin, and LG are currently planning to expand the production capacity of carbon nanotube powder/slurry.

It is worth noting that as the market penetration rate of carbon nanotubes in the power battery field continues to increase, competition among industry giants will become more intense under the Matthew Effect.

1. 2.8 billion new conductive paste market competition

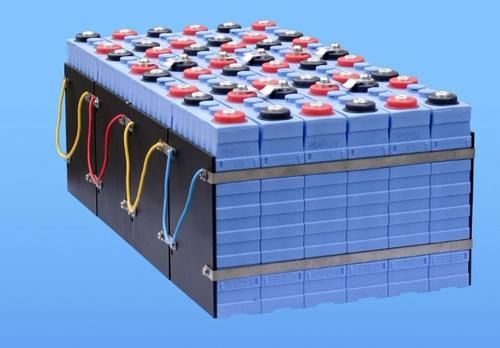

As one of the core raw materials of lithium batteries, carbon nanotube conductive agents are replacing traditional conductive agents at an accelerated rate because they can significantly improve the cycle life and rate performance of lithium batteries.

Depending on the application scenarios, the material ratio of lithium batteries to composite conductive agents is also different. For example: the addition ratio of carbon nanotube powder to ternary power batteries is 1%, the addition ratio of lithium iron phosphate power and energy storage batteries is 1.5%, and the addition ratio of 3C, electric bicycles and power tools is 0.5%.

Generally speaking, the dilution ratio of the conductive agent powder in the conductive paste is about 4%. And the price of carbon nanotube powder dominates the rise and fall of the overall price of carbon nanotube slurry.

Data from the GGII Lithium Battery Research Institute (GGII) shows that driven by the power battery market, China’s lithium battery conductive agent powder shipments in 2019 were 8,278 tons, a year-on-year increase of 6.9%.

Among them, the sales volume of conductive carbon black and conductive graphite in conventional conductive agents (excluding composite conductive agents) were 6,040 tons and 690 tons respectively, and the shipment volume of carbon nanotube powder conductive agents (including their composite conductive agents) was 1,432 tons, a year-on-year increase 10.2%, equivalent to 35,800 tons of carbon nanotube conductive paste (converted to 4% solid content), becoming the strongest growth segment in the conductive agent market.

GGII predicts that in the next few years, China's new conductive agents, especially carbon nanotube conductive agents, will gradually replace traditional conductive agents. By 2020, the market size of carbon nanotube conductive slurries will exceed 70,000 tons.

According to the current price of 38,000 to 41,000 yuan per ton of carbon nanotube conductive paste, the relevant market space is expected to reach 2.66 billion to 2.87 billion in 2020.

Faced with a considerable market space, in recent years, the capital market and large domestic and foreign companies have also made frequent moves in the field of carbon nanotube conductive agents.

Looking back at the major events in the past two years, Tiannai Technology was listed on the Science and Technology Innovation Board, Cabot acquired Sanshun Nano, Dow Technology acquired Qingdao Haoxin, and the penetration rate of carbon nanotube composite conductive slurry in the power battery field exceeded 50%, the leading enterprise market is rapidly gathering. In parallel with this development, there is also the expansion of the production capacity of carbon nanotube powder/slurry.

As the market penetration rate of carbon nanotubes in the power battery field continues to increase, and global production capacity deployment is carried out to meet the needs of power battery giants, the competitive boundaries of leading carbon nanotube companies will continue to widen.

But at the same time, as the power battery market concentrates on giant companies, the barriers to entry for supply chain companies are getting higher and higher. Based on the terminal's strict control over the supply chain, the carbon nanotube conductive slurry market will also be narrowed to a few In the hands of enterprises.

2. Competition between battery giants

Judging from the market structure of carbon nanotube conductive paste, the situation of separatism has begun. According to GGII survey data, among the domestic shipments of carbon nanotube conductive paste in 2019, the shipments of TOP 5 companies accounted for 92.8%. These include Tiannai Technology, Sanshun Nano, Qingdao Haoxin, etc.

Benefiting from the growth in demand for the power battery market, carbon nanotube shipments have shown rapid growth in recent years. From 2015 to 2019, domestic carbon nanotube shipments increased from 8,300 tons to 35,800 tons, and the growth trend is still maintained.

Based on the market growth rate and the considerable market space, the capital market and large domestic and foreign enterprises have recently made frequent moves in the field of carbon nanotube conductive paste.

In April this year, Cabot, the world's leading carbon black material leader, officially completed the acquisition of Sanshun Nano for a price of US$115 million (equivalent to about RMB 800 million), becoming the only company in the world that covers all mainstream lithium battery conductive materials.

Gaogong Lithium Battery learned that Cabot Zhuhai Base started construction in May 2019, and the annual production capacity of lithium battery conductive materials in the first phase is planned to reach 10,000 tons.

As the industry's top seller of carbon nanotube conductive agents in recent years, Tiannai Technology was successfully listed on the Science and Technology Innovation Board in July last year. Tiannai Technology's carbon nanotube conductive slurry production capacity in 2019 is 12,000 tons.

In the IPO fundraising plan, Tiannai Technology raised 1.03 billion yuan to invest in three major projects related to carbon nanotube materials. This includes the expansion of production capacity with an annual output of 3,000 tons of carbon nanotubes and 8,000 tons of conductive paste.

In 2019, Qingdao Haoxin's new conductive paste workshop was successfully completed and put into operation, and its production capacity has also moved from 10,000 tons/year to 20,000 tons/year.

Recently, LG also intends to invest approximately 65 billion won (equivalent to RMB 380 million) to increase the carbon nanotube production capacity of its Yeosu plant in South Korea from 500 tons to 1,700 tons.

It can be seen that the entry of giants, surging capital, production capacity expansion, and cost reduction have become the main theme of the carbon nanotube market at this stage. With the accelerated release of carbon nanotube production capacity, the market competition will become more and more fierce. .

3. Hunan invests in building large cylindrical cobalt-free batteries, aiming to subvert the automotive battery market structure

In February of this year, the news that "Tesla will adopt Ningde era cobalt-free batteries" stirred up waves, stirring up fluctuations in the concept of cobalt and lithium iron phosphate in the securities market.

In fact, the industry guessed that the cobalt-free battery is lithium iron phosphate. Since then, the domestic lithium iron phosphate battery has changed its name to "cobalt-free battery" and has been revived in China.

In February 2020, when the Tesla news came out, Hunan Times was registered and established. Its business includes the research and development, manufacturing, sales and after-sales service of lithium-ion batteries and related products.

Recently, Hunan Times United New Energy Co., Ltd. started construction of the "Lithium-ion Power and Energy Storage Battery Intelligent Industrialization Base". The project has a total investment of 1 billion yuan, of which the cumulative investment in fixed assets is 700 million yuan. The planned land area is 170 acres. The construction period 10 months. It is understood that after the construction of the project is completed, it will integrate the research and development, production and sales of battery cells and PACK, forming an annual production capacity of 4GWh lithium-ion batteries and achieving annual sales revenue of approximately 2.4 billion yuan.

The core product of the project is the "60 series large cylindrical cobalt-free battery". According to OFweek Lithium Grid, compared with the 50 series cylindrical battery, the "60 series large cylindrical cobalt-free battery" retains the advantages of high consistency and high specific energy. It adopts new tab welding technology to achieve better battery rate performance, higher capacity, lower internal resistance, lower temperature rise, better high and low temperature performance, and higher safety.

The products of this project adopt a wet water-based process. It is the first 15-channel lithium-ion battery production process in the world. Compared with more than 40 production processes in the industry, it greatly reduces human quality hazards and effectively improves the battery qualification rate. It independently develops a low-pressure safety valve to collect exhaust gas. The pressure reduction and explosion-proof functions are integrated, and the gas inside the battery can be discharged in time through the low-pressure safety valve, effectively solving the problem of traditional battery expansion and improving battery safety.

Although the product looks good and the manufacturing process is advanced, we have to face the current market situation. The installed capacity of my country's new energy vehicle cylindrical batteries in 2018 was 7106.28MWh, and the installed capacity in 2019 was 4133.69MWh, with the market share shrinking to 6.65%. In addition, statistics show that the top ten leading companies such as Guoxuan Hi-Tech, Lishen Battery, and BAK Battery accounted for 96.5% of the market share in 2019.

The data shows that the overall market share of cylindrical batteries in the domestic new energy vehicle field has been on a downward trend in recent years, and the industry head concentration effect is obvious. So, is it a wise choice for Hunan Times to enter the lithium iron phosphate battery market at this time? Will it have a place in the future?

Proposal recommendation

- TOP