The United States launches an infinite traceability mechanism for semiconductors in Chinese factorie

Last night, the United States conducted an infinite retrospective on Chinese semiconductor companies engaged in national integration, but Chinese semiconductor companies have been operating in strict accordance with relevant industry rules. This incident has had a certain impact on the development of Chinese semiconductor companies. Since last year, the United States has restricted the development of my country's semiconductor technology and included Huawei in the US list. The development of domestic semiconductors has a long way to go.

1. The United States implements unlimited traceability of semiconductors

On the evening of May 12, U.S. semiconductor equipment manufacturers LAM (Lanlin Semiconductor), AMAT (Applied Materials) and other companies issued letters requesting Chinese companies engaged in military-civilian integration or supplying integrated circuits for military products, such as SMIC and Huawei Hong Semiconductor, etc., are not allowed to use the semiconductor equipment of the listed manufacturers in the United States to produce military integrated circuits, and at the same time, the "unlimited traceability" mechanism is in effect.

This also means that U.S. semiconductor equipment purchased by Chinese wafer foundries such as SMIC and Hua Hong Semiconductor cannot be transferred to the military under any circumstances. At the same time, these equipment cannot be used to produce military integrated circuits for the military, even if they are produced It is some civilian integrated circuits that may be used for military purposes, and they cannot be used for military purposes, otherwise the consequences may be serious. There is an example of ZTE.

The so-called unlimited traceability should mean that no matter whether SMIC, Hua Hong Semiconductor, etc. know about it or not, as long as the final product is used by the military, they will be held accountable. It is worth noting that on April 27, the U.S. Department of Commerce announced new restrictions on China’s exports, aiming to prevent Chinese, Russian and Venezuelan entities from obtaining materials for military use through or under the civilian supply chain. American technology is then applied to the military and military end users.

The new regulations further expand the types of items requiring licenses, with semiconductors being a top priority. Although the United States has included a large number of Chinese entities, including Huawei, on the "Entity List" last year, restricting these entities from purchasing related products and technologies including American chips, but for those Chinese semiconductors that are not included in the Entity List, Manufacturers, they use American equipment or technology to produce civilian chips without restrictions.

Now the United States believes that the Chinese military may apply some civilian technologies to military applications through military-civilian integration. Therefore, the U.S. Department of Commerce has upgraded export control measures to prevent this possibility.

The current move by Lam Semiconductor and Applied Materials in the United States is to further implement the newly upgraded export control measures in the United States to prevent semiconductor production equipment from being used by the Chinese military.

2. Domestic replacement chips have a long way to go

Lam Semiconductor was founded in 1980. Since then, it has become the world's fifth largest semiconductor equipment manufacturer through the acquisition of OnTrak Systems Inc., Bullen Semiconductor, SEZ AG Group and other semiconductor equipment manufacturers. The products mainly include etching equipment, thin film (Deposition-CVD/ECD/ALD) equipment, photoresist removal and cleaning (Strip&Clean), copper plating and other equipment. In 2017, the sales of etching equipment accounted for approximately 45% of the global market share, ranking first in the world. Among them, conductor etching accounted for more than 50% of the global market share, ranking first in the world; dielectric etching accounted for approximately more than 20% of the global market share. , second in the world. CVD accounts for about 20% of the global market, ranking third in the world.

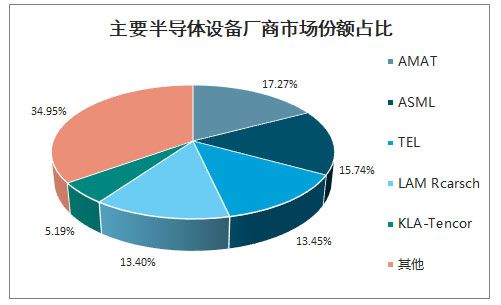

According to statistics from VLSI Research, global sales of semiconductor equipment systems and services in 2018 were US$81.1 billion. Among the top five equipment manufacturers, Applied Materials ranked first with a market share of 17.72%, and Lam Semiconductor ranked first with a market share of 13.4%. Four.

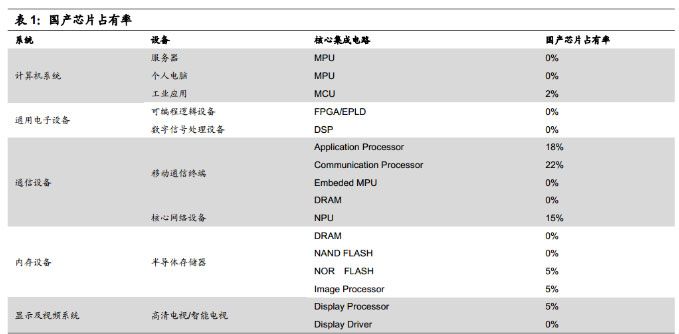

The direction of the localization of semiconductors has been deeply rooted in the hearts of the people. The word "stuck neck" more vividly let the market know the shortcomings of our technology. ZTE and Huawei were suppressed by the trade war, which completely pushed the localization of semiconductors to a climax. Therefore, there is no need to go into details about the localization of semiconductors here. The 0% in the figure below is a very eye-catching reminder to the market that the road to localization of semiconductors is still long and it will be a protracted war. Change.

In recent years, China has made great progress in semiconductor design, packaging and testing and other fields. In the field of semiconductor equipment, domestic semiconductor equipment manufacturers such as North Huachuang and Zhongwei Semiconductor have achieved good results in the fields of thin film deposition equipment and etching machines, but there is still a big gap between domestic semiconductor equipment and foreign manufacturers as a whole. Domestic semiconductor manufacturing relies heavily on foreign semiconductor equipment.

Against this background, it is completely impossible for China's wafer foundries to avoid the world's No. 1 and No. 4 semiconductor equipment giants.

It is worth noting that in order to accelerate the production of 14nm, on January 24 this year, SMIC, the largest wafer foundry in China, issued an announcement announcing that the company had reached an agreement on commercial terms for 12 months from February 2019 to January 2020. During the month, a series of purchase orders were issued to Applied Materials for machinery and equipment for a total consideration of approximately US$620 million.

Then on February 18, SMIC announced that the company issued a series of purchase orders to Lam Group for machines and equipment during the 12 months from March 12, 2019 to February 17, 2020, at a total cost of 6.01 billion U.S. dollars (about 4.2 billion yuan).

3. The Trump administration wants chip factories to build factories in the United States

Two major chip manufacturers, Intel Corporation and Taiwan Semiconductor Manufacturing Co., Ltd. (TSMC) confirmed to Reuters on the 10th that the U.S. government is negotiating with a number of semiconductor companies to build chip foundries in the United States.

The Fox Business News website of the United States, which has always been conservative in its stance, said that the new crown epidemic has deepened the concerns of American political and business people about global supply chain issues, and many people hope to reduce the United States' dependence on Asian supply sources in the core technology field of semiconductors.

Intel spokesman William Moss confirmed to Reuters via email that day that the company was discussing with the U.S. Department of Defense to improve U.S. domestic supply sources for microelectronics and other related technologies.

TSMC spokesman Gao Menghua issued a statement on the same day confirming that he is discussing with the US Department of Commerce about building a plant in the US, but no final decision has been made. We are actively evaluating all suitable locations, including the United States, but have no specific plans yet.

American chipmakers have been reluctant to build factories in the United States in recent years due to high costs and short technology development cycles. However, chip manufacturers have recently become more willing to return to their home countries, mainly due to concerns about the vulnerability of Asian supply chains and the rising demand of the U.S. defense industry for the use of locally produced high-end chips.

An influential Pentagon report last year pointed out that the U.S. digital industry is highly dependent on China and South Korea, especially Taiwan, which is extremely important to most of the largest and most important technology companies in the United States. The report recommends that the U.S. government adjust its policies to address the problem.

According to the Fox Business News website, among dozens of semiconductor manufacturers in the United States, only Intel has the ability to produce chips of 10 nanometers and below. This chip is the fastest and consumes the least power. The other two manufacturers capable of producing chips of the same level are TSMC and Samsung. TSMC’s financial report last year showed that the company manufactures products for many American chip companies such as Qualcomm and Broadcom.

The economic stimulus measures introduced by the U.S. government to ease the impact of the epidemic have also helped to push chip manufacturers back to their hometowns to a certain extent. People familiar with the matter disclosed that the U.S. government increasingly regards chip manufacturing as a key industry related to national security, and stimulus policies may be tilted towards the chip industry, which means that related companies will receive more financial support.

Proposal recommendation

- TOP